Categories: General Tax Terms

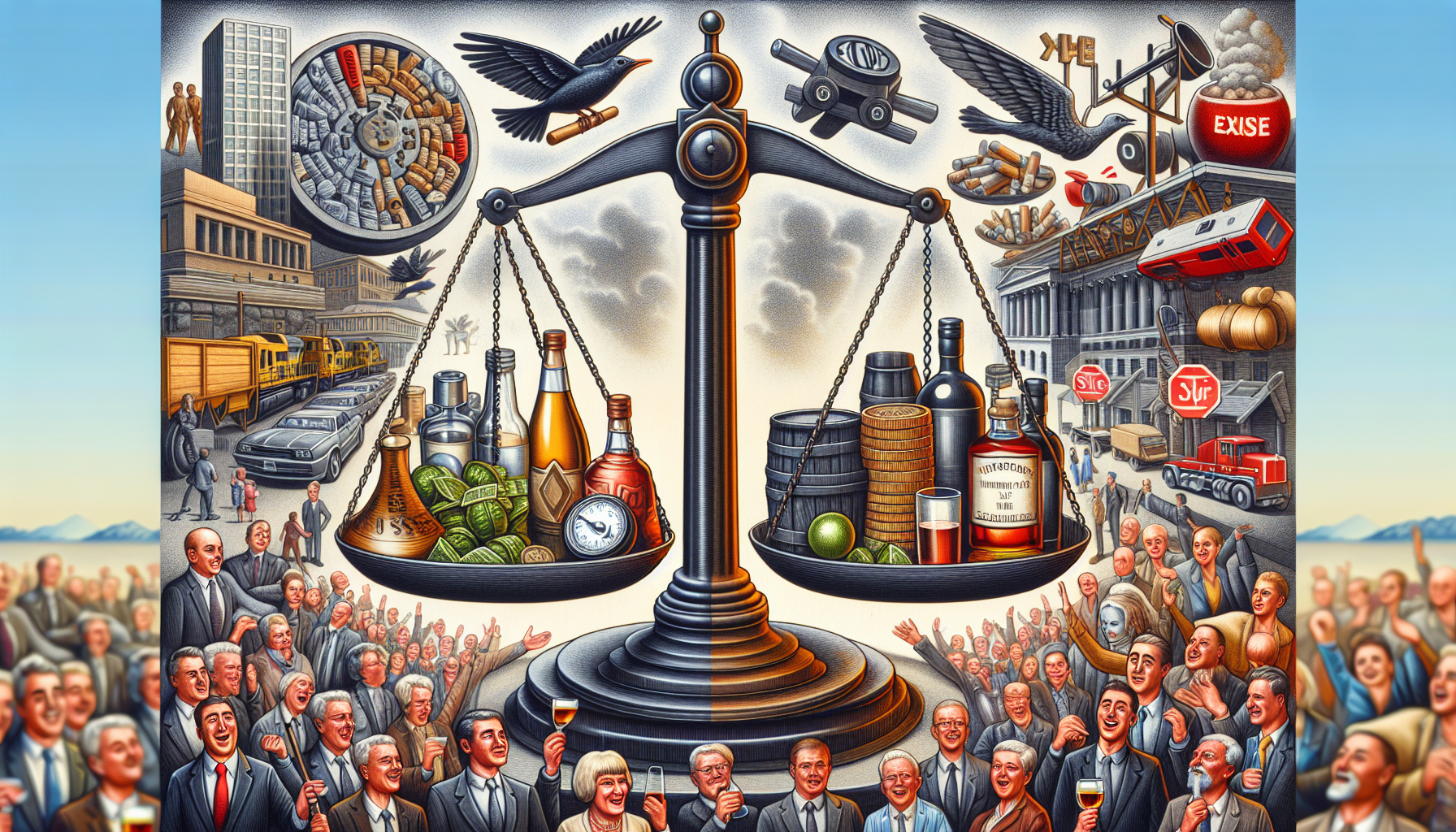

Excise Tax

An excise tax is a type of indirect tax imposed on specific goods, services, or activities. Unlike sales tax, which is levied on a broad range of consumer purchases, excise taxes are typically applied to particular items such as gasoline, alcohol, tobacco, and certain luxury goods.

Excise taxes can be based on the quantity purchased (specific excise taxes) or the value of the item (ad valorem excise taxes). These taxes are often included in the price of the product and are paid by the manufacturer or seller, who then passes the cost onto the consumer. For example, a federal excise tax on gasoline is applied on a per-gallon basis, impacting the overall price at the pump.

« Back to Glossary Index